I.

All writing is metaphor creation.

Heck, as far as I can tell, all thought is metaphor creation. This is like that and that is like this. And recently, I accepted a friendly challenge to write about financial metaphors. More specifically, how they apply to friendships. And whether they should even be brought into this sacred arena.

However, the fact that there are useful metaphors in finance is a widely accepted one. Byrne Hobart, one of the best metaphor-wielders in the business, explains why: Markets are laboratories for the study of human behaviour, and as such they provide a great arsenal of vocabulary for explaining the non-financial world.

So it can be done. Whether or not it should be done is something I'll get into soon enough. But first, I want to point out that the erosion of friendship by financialization is not something that I fear. The very definition of such a process is directly counter to the idea of friendship.

To make that clear, here's a definition from a Vitalik blog post: Finance can be viewed as a set of patterns that naturally emerge in many kinds of systems that do not attempt to prevent collusion.

But what is friendship if not the purest, most fun form of collusion? Where common knowledge as a comparitive advantage is both invited and encouraged. To the dismay of autists everywhere, there is no free market in pals.

Even finance in the real world usually operates with a few relationships thrown in. Wall Street is still, despite Jane Street’s best efforts, run by people. People who’ve known each other for years, and wouldn’t let a few anti-trust laws spoil a good dinner party. (“My, what a large web of connections you have.” “All the better to screw you with.”)

So no, your friends are not going to be funged away, not even by rentafriend.com. You don’t have to live in the pod if you don’t want to y’know?

It is also true that financialized systems are much more stable if their incentives are anchored around a system that is ultimately non-financial. - Vitalik

The important life lessons are not about how to imitate finance, but about how to find real life scenarios that resist financialization and still allow for outsized returns. -Applied Divinity Studies

The relatively harmless application of metaphor, on the other hand, is simply the stock-and-trade of any internet writer. Few methods of achieving insight are as easy and direct than slapping together a couple of similar ideas and seeing what sticks. Sometimes the results aren't entirely pure and true. But it makes for entertaining reading all the same. The real point is to highlight similarity in a sea of difference.

we cut the world into pieces with words, distinctions, categories. analogy and metaphor sews things back together, reminds us of the inherent sameness of everything - Amir

"But muh pure friendships and fun. Surely, even viewing people as economic entities is hyper-utilitarian and bad.”

I'm not so sure about that. Most dichotomies are false, why would this one be unquestionably true? I think there's a healthy degree of economic comparision to be applied here. Maybe some of them will seem like cliches or tautology, but I hope that at least a few will help me make my points better.

II.

So let's financialize some friendships, shall we?

To begin with, we need to find the metaphors that apply best. Are friendships a product or service? A fund or cooperative? A security or company?

The popular metaphor seems to be of friendship as a product, and friends as home economicus, as selfish agents engaging in mutually beneficial iterated games. But this the boring perspective, one that's trundled out every time some old geezer wants to lambast the "shallowness of modern relationships". The criticism levied at social butterflies, try-hards and other people seemingly optimizing purely for the largest networks.

But that gets stale pretty fast. And doesn't really say anything, y'know, nice. It is funny, though. VC investing (holding a broad portfolio of small bets) is praised as an innovative paradigm shift in start-up funding. But if you try to do that for your friend-making, you're branded a shallow oppurtunist? Seems fair.

I joke, of course. There are probably other reasons such a strategy doesn't work for relationships. Maybe it's because the comparision is foundationally flawed. Unlike purely financial investments (where writing a check is an act that can be scaled infinitely), friendships usually require an intentional tending, a ritual of rhythm and taming. Making them impossible to greedily optimize past a certain scale. Sure, everyone has different Dunbar numbers, but the inane and ordinary seem to be a necessary and unavoidable rite in the process of trust-building.

Sure, you can be more intentional about it. In fact, I recommend that you do. The older you get, the less time you have to feel out a new acquaintance. You both need to rush past the initial wait-and-watch phase as quickly as possible. But trust is still hard to build, not matter how effectively you work, some things take time.

But enough with the product metaphor. The decidedly better perspective is thinking of yourselves as a company. Look, if Byrne could get away with comparing your life to a call option, I'm allowed to equate friendships to companies, at the very least.

In the 1990s, Japan experienced the Lost Decade, a period of painfully slow growth lasting all the way through to the 2000s. During this time, a series of...ahem, sub-optimal decisions by their central bankers led to what are called zombie companies. These are companies that remain in business but are so deeply in debt that they’ll never have enough post-tax earnings to be profitable. They're dependent on new loans to pay back their old ones. Able to stay in business and pay interest on said loans, but never breaking free of their reliance on debt financing.

And if I'm being honest, the vast majority of friendships work like these companies. Limping on purely on the backs of shared environment and circumstance. Never really striving to be more, or attempting to consolidate a promising relationship.

To me, you are still nothing more than a little boy who is just like a hundred thousand other little boys. And I have no need of you. And you, on your part, have no need of me. To you, I am nothing more than a fox like a hundred thousand other foxes. But if you tame me, then we shall need each other. To me, you will be unique in all the world. To you, I shall be unique in all the world . . . - The Little Prince

You'll have to excuse the sappiness, but he makes a good point. The deliberate nature of friendship maintenance is oft-ignored in favour of the easy, effortless bonding of extrinsic circumstance. How many people rely simply on the “organic” way in which friendships are acquired? Through chance rendezvous and random invitations to forced conversations or (perhaps the worst possible strategy) depending on one’s “mood”?

I'm not entirely sure why this is. There does seem to be a norm about trying to have "easy friendships", the effortless vibing that comes with years of familiarity. Which, admittedly, is one of the best things about knowing people1.

Even zombie companies aren't the worst thing in the world. Heck, my Marxist heart, quite unashamedly, celebrates the fact that they kept thousands of people employed during the recession. And circumstance that brings folk together is a good thing, for the most part. Regardless of whether of not they consolidate that connection.

But on the other hand, it does seem like a tremendous waste of capital. Social capital, that is. Years of trust, familiarity and mutual comfort that never lead anywhere amazing.

I'm mostly curious about the odd deadly purgatory between acquaintance and friendship, where two people are making more than occasional time for each other, but not progressing towards anything deeper. Perhaps there's an opportunity for these to blossom into deeper purpose, collaboration, and meaning. - Nadia Eghbal

I think it's ridiculous how much slack is available to people just from having friends they can trust vs. friends that just...exist. Think about it, you can take a year of from life to go do...literally whatever you want. As long as you're sure you've got people to look out for you if you need it.

But most people will never take advantage of this cushion!2 Partly because, again, social norms are against it, but also because they're not sure if they can/should.

So let me say this: Your friends; if they're any good; want to help you. Unless you give them really strong reasons not to. The fact that you refuse to allow this to happen is downright negligent. If you were a company, your shareholders would sue for mismanagement. And deservedly so, you're implicitly shorting your own stock.

Individuals and friends groups are way underinvested in themselves. If they were a company we’d be horrified in the lack of long term investment. - Kevin Kwok

Except, you're also the shareholders. So if you aren't all in, you're decidedly short. For all your sakes, get your capital working! For once, I am in support of unashamed maximisation of returns. Because these are the best kind of profits. The squad economy primarily yields non-monetary forms of value.

III.

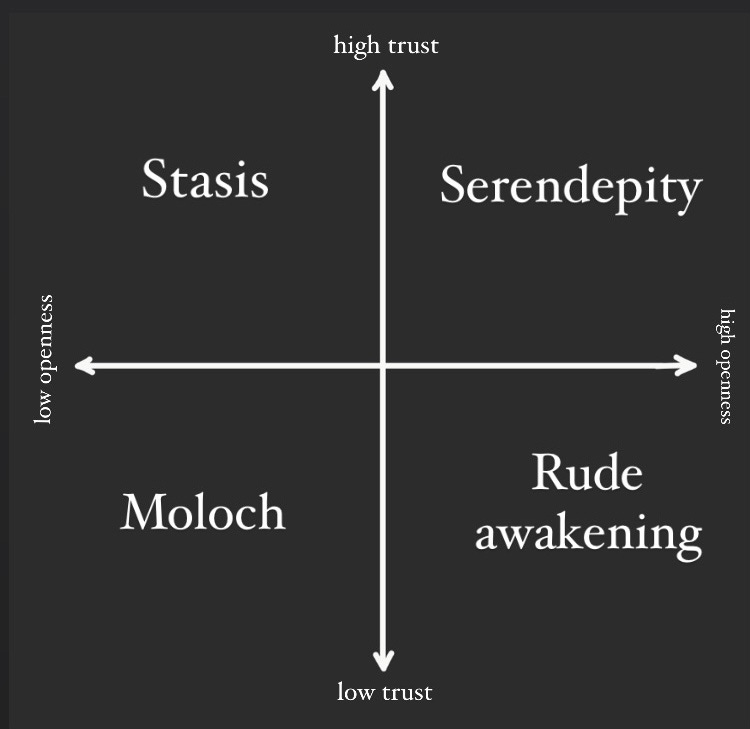

It's hard for us humans to understand serendipity.

It's even harder to imagine hypotheticals. And so it gets a bit messy when we try to dig into the returns to just...having friends.

EV of knowing people is literally higher than any reasonable bet. It’s not even close. - Guillermo Angeris

Consider the following possibility. You spend a couple of hours a day in bars, hoping to run into a millionaire. Upon meeting one, you do your best to impress them/save their life or do whatever else it takes to befriend them. The probability of this happening depends on the location and clientele of said bar, but is probably higher than you think.

They don't have to literally give you a slice of their money. All it takes is a great recommendation/offer/helping hand and suddenly, your life is like, 3x better than it would be.

now you know why i’m crazy all the time - Visa

What's the alternative? You work your ass off for a decade. Make partner in your late 30s but continue working 80 hour weeks because the competition is getting more intense. Sounds pretty brutal. When a man goes up against the world alone, he usually gets crushed.

Let’s run the cost-beneifit analysis vs. the first scenario. Sure, you've got no garuntees of being that lucky. So the benefit for the millionaire-rendevous is lowered by the randomness, but the cost is laughably low. Especially compared to the other path, where a surer reward comes at a proportionately higher cost. There’s no alpha in slaving away. You get nearly exactly what you put in.

On the other hand, simply knowing people allows near infinite variance in outcomes. All it takes is a few hours at a bar (or other publically-sanctioned friend-making place). And Twitter is the world's bar.

Seriously though, nobody is really going to follow through on this suggestion. Not even me, mostly because I don't really like bars. The meet-a-millionaire outcome it seems just a tad too unlikely.

But you don't need to meet a millionaire. It's probably enough to meet the millionaire's friend. Or y'know, literally anybody that would bring a step-change improvement in your life. Non-monetary benefits are often bigger improvements than a pure cash payout.

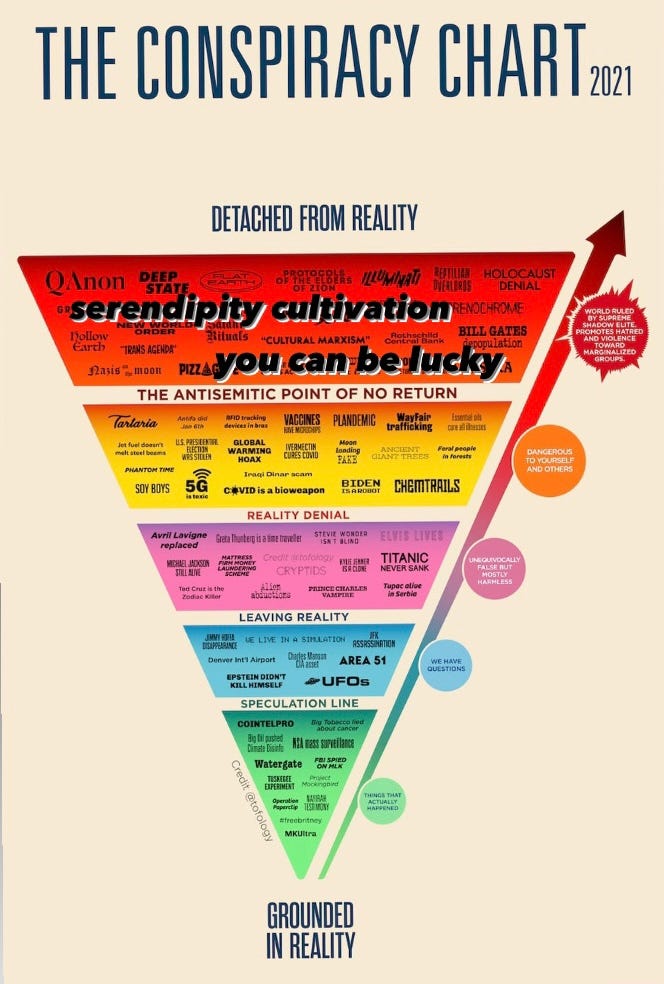

The fact that this idea seemed so silly at first read seems to be part of a broader societal conspiracy to obfuscate the role of serendipity. On par with the moon landing and Epstein, the Deep State simply do not want you to imagine what luck can do. I'm exaggerating, but not by very much.

You see this aversion everywhere. From naive attempts to simplify causality (*ahem* linear regression *ahem*) to selection processes that ignore variance.

I get why it's done. You can have simpler, more manageable models of reality if you ignore that annoying noisy component: luck. Linear extrapolations and medians are easy to calculate. Unpredictable exponentials are annoying.

But you do so at your own peril. Because sometimes, all it really takes is having the right roommate at Harvard.

It isn't even that hard to make friends. Sure, nerds are cowards, but that just means you can be the bold one. “But It's difficult to tell who you can trust”- nah, it isn't. The vast majority of people are leaky, you can spot the lies (if any) within days at most. It's stastically unlikely that you'll run into just the few good liars.

Selection effects make that even more improbable. I'm well aware of who my audience is: the 1%. If you've got what most people in the world don't: access to the internet and a Substack account; you no longer have much need to lie. And neither do most of the people you interact with. The nice thing about post-scarcity is that it makes positive sum games more desirable to everyone.

And if there's one theme that I will keep harping on about. It's that what the world really needs, is more positive sum games. Now please go create some with people you love.

IV.

But let's get back to finance metaphors.

To be honest, this was a fun post to write. Even the cliché parts work better when I can hide them behind a pretense of this-is-official-business-stuff seriousness. But there’s still a few (mosltly playful) analogies I wanted to point out, just not enough to warrant a detailed explanation for each. So I’ll go over them quickly to end this post here:

Capital Expenditure (CAPEX): Active friend-making does take time and energy. As does maintainance and cultivation of your current ones. And while the optimal amount of cultivation is probably higher than most people think, few endevours are as easy to bear. Spending your capital is a pleasureable experience for once.

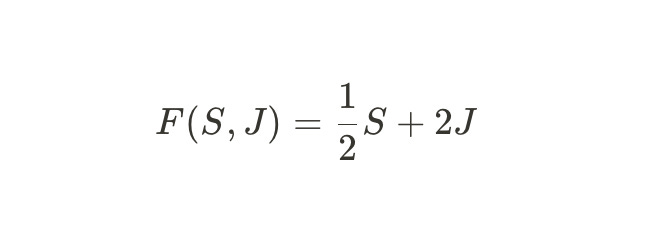

Multiple On Invested Capital (MOIC): A friend halves our sorrows and doubles our joys. That’s a line (inconclusively) attributed to Francis Bacon. And it gives me an excuse to break out LaTeX to provide you with this handy formula:

Lifetime Value (LTV): This is equivalent to calculating the expected value. And so we can be sure that, in the long run, there’s going to be some incredibly high variance. Almost purely in the positive direction. But there's also the more Adam Smith benefit of specialised labour. The value each friend provides is a complement more often than it is a substitute.

Customer Acquisition Cost (CAC): Again, you've got to put in the effort to go out looking for people. Luckily though, each friend usually introduces you to a whole host of others. (Network effects or something.) It still isn't the easiest thing to do, especially if the people you want to find are the reluctant sort. So get working on your marketting funnel, godammit!

Have you even known someone unless you've spent entire afternoons lying around doing absolutely nothing?

Cusions are good things, actually. The arguments against them are kinda weak.